Introduction: What Special Payments Mean for Public Sector Workers in 2026

The announcement of special payments for public sector workers in 2026 has generated widespread interest among government employees across multiple sectors. With inflationary pressures, rising living costs, and increasing demands on public services, these special payments are intended to provide financial relief, reward service, and strengthen workforce morale.

Table of Contents

Public sector workers—including teachers, healthcare professionals, administrative staff, security forces, and municipal employees—form the backbone of essential government services. Recognizing their contribution, the government has outlined a range of additional financial benefits beyond regular salaries for 2026.

This article provides a detailed breakdown of special payments for public sector workers in 2026, covering eligibility, types of payments, expected amounts, payment schedules, and their broader economic impact.

What Are Special Payments for Public Sector Workers?

Understanding Special Payments and Allowances

Special payments refer to additional financial compensation paid to public sector employees outside their base salary. These payments may be issued as bonuses, allowances, incentives, or temporary relief measures.

They are typically designed to:

- Offset inflation and cost-of-living increases

- Reward performance or service duration

- Support workers during economic transitions

- Address sector-specific challenges

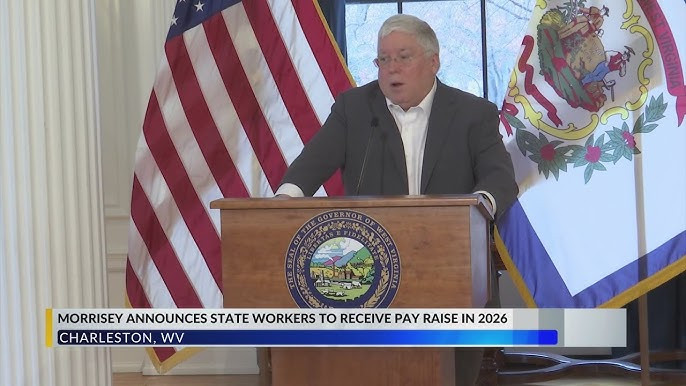

Why the Government Is Offering Special Payments in 2026

Economic and Social Factors Driving the Decision

Several factors have influenced the decision to implement special payments in 2026:

- Rising cost of essential goods and services

- Increased workload in key public sectors

- Retention challenges in education and healthcare

- Economic recovery and fiscal reforms

The government aims to balance fiscal responsibility with social protection for its workforce.

Key Highlights of Special Payments for Public Sector Workers in 2026

Main Features at a Glance

The 2026 special payments program includes:

- One-time and recurring payments

- Sector-specific bonuses

- Automatic disbursement for eligible workers

- Payments made alongside or separate from salaries

These measures ensure accessibility and administrative efficiency.

Types of Special Payments for Public Sector Workers in 2026

1. One-Time Government Bonuses

One-time bonuses are lump-sum payments issued to eligible workers, often tied to:

- Budget approvals

- National economic measures

- End-of-year or mid-year support

These bonuses provide immediate financial relief.

2. Cost-of-Living Allowances (COLA)

Cost-of-living allowances are designed to:

- Protect purchasing power

- Adjust income based on inflation

- Support workers in high-cost regions

These allowances may be revised periodically throughout 2026.

3. Performance-Based Incentives

Some public sector roles qualify for incentives based on:

- Productivity metrics

- Service quality

- Achievement of departmental goals

This approach encourages efficiency and accountability.

4. Sector-Specific Payments

Certain sectors receive targeted payments, such as:

- Healthcare hazard allowances

- Education support stipends

- Security and emergency service bonuses

These payments recognize unique job demands.

Who Is Eligible for Special Payments in 2026?

Eligibility Criteria Explained

Eligibility generally includes:

- Active public sector employees

- Contractual or permanent staff

- Employees registered in government payroll systems

Some payments may have additional criteria based on role or service duration.

Categories of Eligible Workers

Eligible public sector workers may include:

- Teachers and education staff

- Healthcare workers

- Civil servants and administrative personnel

- Law enforcement and military staff

- Municipal and regional government employees

Who May Not Qualify for Special Payments?

Exclusions and Limitations

Certain individuals may be excluded, such as:

- Retired public sector workers

- Employees on extended unpaid leave

- Workers under disciplinary suspension

Eligibility details are usually clarified in official announcements.

Special Payments Amounts for Public Sector Workers in 2026

How Payment Amounts Are Determined

The value of special payments depends on:

- Government budget allocations

- Job classification and grade

- Years of service

- Economic conditions

Amounts may vary across departments and regions.

Are Increases Expected Compared to 2025?

Government officials have indicated that:

- 2026 payments may reflect inflation adjustments

- Some bonuses may be higher than previous years

- Periodic reviews will guide final amounts

Payment Schedule: When Will Special Payments Be Made in 2026?

Expected Payment Timeline

Special payments may be issued:

- Monthly (as allowances)

- Quarterly

- As one-time disbursements

Exact dates will be announced through official channels.

How Workers Will Be Notified

Notifications typically occur via:

- Payroll statements

- Official government portals

- Internal departmental communications

How Special Payments Will Be Paid

Payment Methods Used

Payments are generally made through:

- Direct bank deposits

- Government payroll systems

- Digital payment platforms

This ensures transparency and timely delivery.

Currency and Tax Considerations

Payments are made in local currency and may be:

- Taxable or partially exempt

- Subject to statutory deductions

Employees are advised to review payroll details carefully.

Impact of Special Payments on Public Sector Workers

Financial Relief and Job Satisfaction

Special payments help workers:

- Manage rising expenses

- Reduce financial stress

- Improve morale and motivation

This contributes to workforce stability.

Effect on Service Delivery

Improved compensation can lead to:

- Higher productivity

- Better service quality

- Reduced absenteeism

Comparison With Previous Years’ Special Payments

How 2026 Differs From Earlier Programs

Compared to previous years, the 2026 initiative may offer:

- More structured payment schedules

- Enhanced transparency

- Better targeting of critical sectors

Challenges and Concerns

Is the Support Enough?

Despite positive impacts, some concerns remain:

- Payments may not fully offset inflation

- Unequal distribution across sectors

- Budget sustainability challenges

What Public Sector Workers Should Do Now

Steps to Ensure Eligibility

Workers should:

- Verify payroll information

- Update personal records

- Monitor official announcements

Avoiding Scams and Misinformation

Employees should rely only on:

- Official government statements

- Authorized payroll systems

Future Outlook: Will Special Payments Continue Beyond 2026?

Government Plans and Policy Direction

Officials have suggested that:

- Special payments will remain under review

- Long-term wage reforms may be considered

- Public sector compensation will evolve with economic conditions

Conclusion: Why Special Payments for Public Sector Workers in 2026 Matter

The special payments for public sector workers in 2026 represent a significant step toward supporting those who deliver essential public services. By offering bonuses, allowances, and targeted incentives, the government aims to ease financial pressure, recognize service, and maintain a motivated workforce.

While challenges persist, these payments highlight the importance of public sector employees in national development. Staying informed and engaged with official updates will help workers fully benefit from the 2026 special payment programs.

1. What are special payments for public sector workers in 2026?

Special payments are additional financial benefits provided by the government to public sector employees in 2026. These may include bonuses, allowances, incentives, or one-time payments issued outside of regular salaries.

2. Who is eligible for special payments in 2026?

Eligibility generally includes:

Active public sector employees

Permanent and contractual government workers

Employees registered in official government payroll systems

Specific payments may have additional criteria based on role or sector.

3. Which public sector workers will receive special payments?

Special payments may apply to:

Teachers and education staff

Healthcare workers

Civil servants and administrative staff

Law enforcement and security personnel

Municipal and regional government employees